Subscribe to our Weekly Investment Update

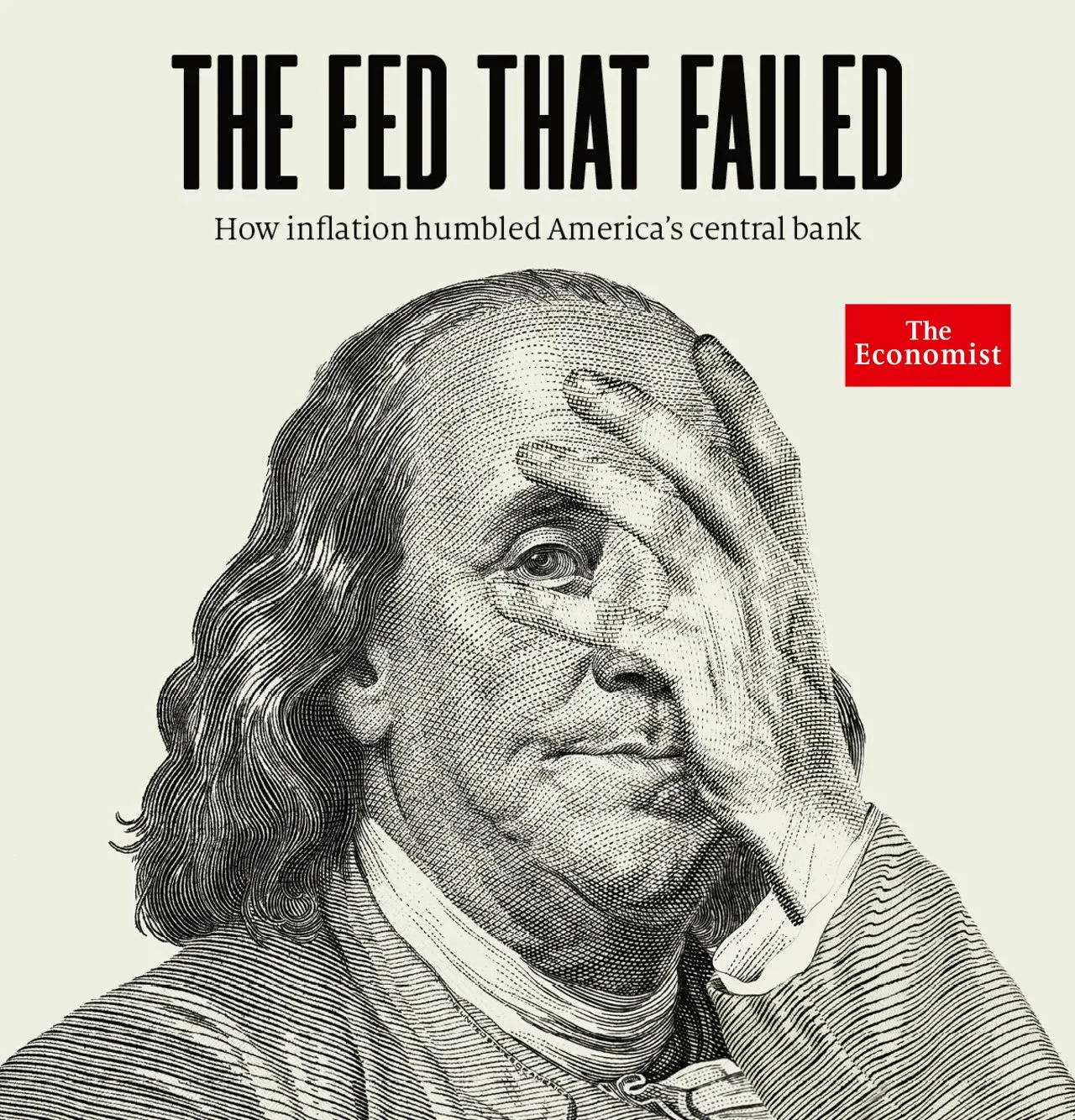

Will the Federal Reserve Finally be Reformed?

President Trump has announced his nominee to replace Jerome Powell at the Federal Reserve. Kevin Warsh is an excellent choice who should bring much-needed regime change to the Fed.

Markets Calm Dispite Barrage of Headlines

Headlines have been relentless since the start of the new year. Between a ramp-up in geopolitical tensions, fresh threats to Fed independence, and a string of policy proposals aimed at affordability, the market has had lot to digest. Despite the noise, stocks have barely flinched, maintaining a sense of calm.

2026 Investment Outlook: Bubble Watch & the Elusive Pin

2026 Investment Outlook

Every Wall Street analyst is predicting another positive year. Those of us on bubble watch know that extreme bullishness is a contrarian indicator, but the pin has been elusive. Why?

10 Market Rules to Remember

This week I want to review some timeless concepts that are especially important in light of today’s market euphoria.

Is AI the Next Global Crossing?

AI is groundbreaking technology. It’s a technological advancement that could be bigger than the internet itself. Like the dot-com bubble, the irrational exuberance in AI is not in the idea or the innovation; it’s in the price and investor behavior.

Conflicting Signals into Year-End

With consumer confidence and business activity declining, you’d expect investor confidence and market analysts to be in a cautious mood, but that is not the case. This is just one of many interesting contradictions and interesting dynamics at play as we move into 2026.

My Barron’s Article: Is Bitcoin Highly Correlated to Stocks?

Since the launch of spot Bitcoin ETFs in early 2024, investors have been haunted by a persistent narrative: “Bitcoin is just a tech stock on steroids.”

So while Bitcoin and the stock market are influenced by some of the same market forces, they are by no means tethered to one another.

Stocks Near Record High as Inflation Ticks Higher

The S&P 500 closed the week within 1% of its record high as the Personal Consumption Expenditures price index (PCE) rose 0.3% on a monthly basis, which lifted annual inflation from 2.7% to 2.8% in September. The Federal Reserve will announce its final interest rate decision of 2025 on Wednesday as new concerns about the labor market headwinds, tariff effects and sticky inflation are taking their toll on consumers.

(Mis)Understanding China

The prevailing Western narrative on China is fundamentally flawed. Since 2018, China has executed a massive, strategic reallocation of capital—moving away from debt-fueled property expansion and into high-tech industrial self-sufficiency.

Nervous Investors Sell Stocks & Bitcoin

Uncertainty about the impact of potentially over-investment in AI infrastructure lies at the heart of the AI bubble concerns and it’s starting to shake investor confidence. The sell-off in bitcoin intensified last week as the price of the most widely traded cryptocurrency sank to the lowest level in seven months.

U.S. Fiscal Dominance & the Global Rebalancing

Fiscal dominance is a conflict where the government's need to finance its spending and manage its large debt becomes so critical that it prevents the central bank from doing its primary job of controlling inflation.

Economic Cracks Widen

Last week’s market weakness coincides with growing economic concerns, as corporate bankruptcies rise, October layoffs hit a 20-year high, and consumer sentiment falls. Meanwhile, lawmakers appear to be advancing a deal that could soon end the record-long government shutdown

The Tide of Liquidity is Going Out

For years, asset markets have been surfing a wave of liquidity. Unleashed by ZERP and fueled by central bank balance sheet expansion and government deficit spending, the rising tide of liquidity has been the primary driver of the everything bubble. But the tide of liquidity is starting to go out.

The Fed's Real Priority

The Fed meeting will dominate investor attention in the week ahead, with a host of important data releases, including GDP growth, PCE inflation and employment costs, likely to be delayed by the ongoing government shutdown.

The New Arms Race: Rare Earth Minerals

The U.S. trade fight with China the trade story is far from over and, contrary to what you might read in the headlines, China has the upper hand – at least for now.

Gold’s New Standard

The fate of the entire U.S. equity market now rests on the shoulders of the Magnificent 7 and their collective future is almost entirely staked on the success of artificial intelligence. The stakes have never been higher.

Why I’m a Solo Advisor

The fate of the entire U.S. equity market now rests on the shoulders of the Magnificent 7 and their collective future is almost entirely staked on the success of artificial intelligence. The stakes have never been higher.

The Expanding AI Bubble

The fate of the entire U.S. equity market now rests on the shoulders of the Magnificent 7 and their collective future is almost entirely staked on the success of artificial intelligence. The stakes have never been higher.

The Case for Emerging & Frontier Market Debt

Emerging and frontier market bonds offer a compelling investment opportunity and play an important role in our clients’ portfolios. Emerging and developing economies represent about 85% the world's population and 60% of global economic output (GDP). Despite attractive historical performance and strong fundamentals, this asset class has been almost entirely ignored by investors and professionals alike.

The Federal Reserve is About to Have an Extremely Awkward Meeting

The Federal Reserve is widely expected to announce a rate cut on Wednesday amid a rash of concerning economic data and the presence of two Fed governors in an active legal battle.