The Case for Emerging & Frontier Market Debt

Weekly Investment Update | By Brian Schreiner

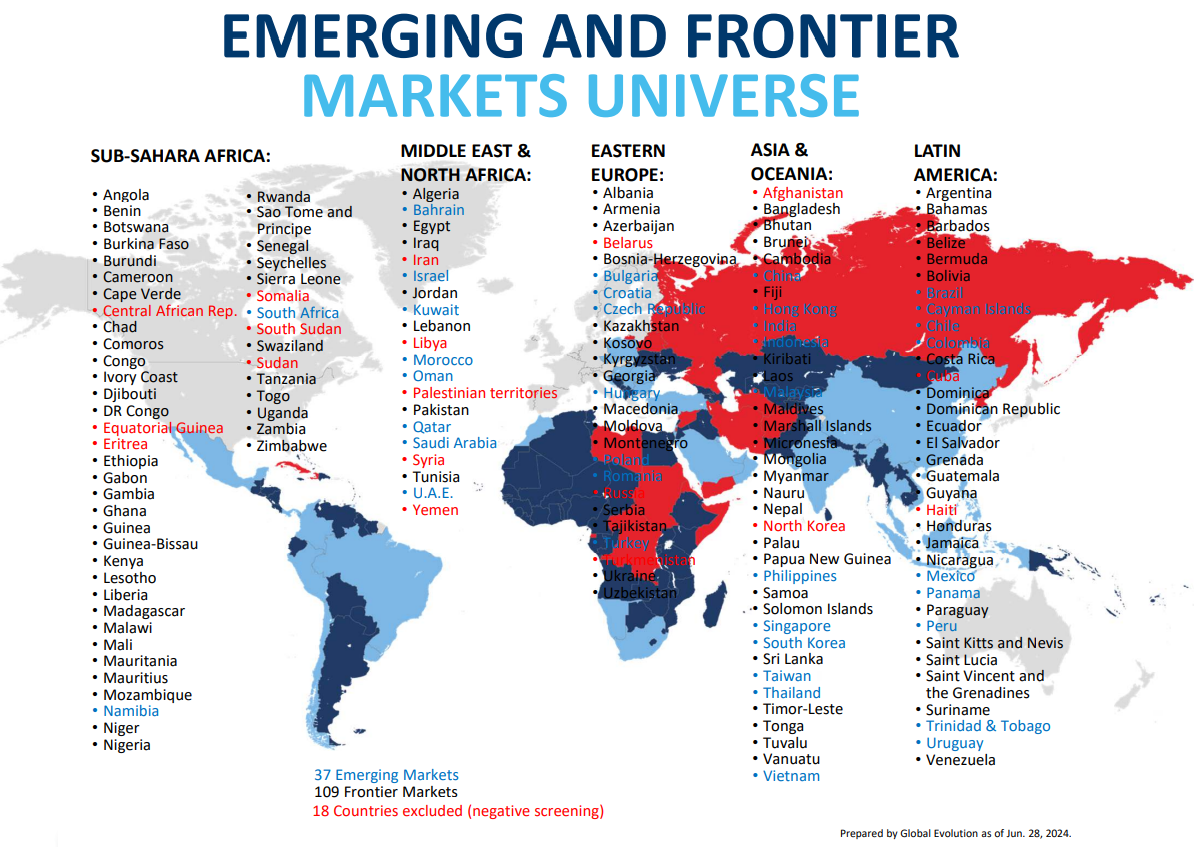

Emerging and frontier market bonds offer a compelling investment opportunity and play an important role in our clients’ portfolios. Emerging and developing economies represent about 85% the world's population and 60% of global economic output (GDP). Despite attractive historical performance and strong fundamentals, this asset class has been almost entirely ignored by investors and professionals alike.

Today’s letter is a preview of our Quarterly Investment Outlook, where I discuss all of our portfolio positions in depth, explaining exactly what we own and why. The Outlook will go out to clients on October 6th. If you’re not a client and would like a copy, email me and please type “Outlook” in the subject line.

What is an “Emerging Market” Economy?

An emerging market is the economy of a developing nation that is becoming more engaged with global markets as it grows. These countries are in a transitional phase, moving away from a traditional, often agriculture-based economy, towards a more industrialized and mixed economy with a growing service sector. While not yet possessing the fully developed infrastructure or stable markets of an advanced economy, such as the United States, Japan, or Germany, emerging market economies are generally classified as such based on a combination of the following characteristics:

Rapid economic growth

Increasing per capita income

Developing financial markets and liquidity

Improving regulatory and legal frameworks

Progress towards open, market-based economy

What is a “Frontier” Economy?

A frontier market is a developing country's economy that is less advanced than an emerging market but more developed than the world's least-developed countries. Think of it as the "pre-emerging" stage, representing the next frontier for global investment. These economies have investable stock markets, but they are generally smaller, riskier, and less accessible than their emerging market counterparts. Frontier markets are defined by several key traits:

Relatively small economic output

High growth potential from a low base growth rate

Growing consumer class

Financial markets with limited liquidity and access

Prone to political instability, currency volatility, and/or weak legal institutions

Key Pillars of the Investment Opportunity

Higher Yield Potential: Bonds from emerging and frontier markets typically pay higher rates of interest to investors than bonds from developed countries. This extra yield is a reward for taking on what's seen as a higher level of risk. As the recent, rapid cycle of higher interest rates in developed countries comes to an end, the environment for emerging and frontier market debt is improving. We expect investor confidence to grow, which should boost the value of EMD.

Diversification: Adding EMD to a core portfolio can enhance diversification across regions, credit qualities, and yield curves. EMD has historically exhibited relatively low correlations with other fixed income sectors, especially developed market government bonds. This diversification becomes particularly valuable during periods of volatility in developed markets.

Exposure to the World’s Fastest-Growing Economies. Emerging and frontier market economies typically expand much faster than developed ones, due to factors such as industrialization, favorable demographics, and a rising consumer class. As growth in developed markets is slowing, the growth gap between developed and emerging/frontier markets is expected to widen. According to the IMF, emerging economies are projected to grow by 3.7% in 2025 and 3.9% in 2026. For comparison, developed economies are only expected to grow by 1.4% and 1.5% over the same periods.

Improving Fundamentals: Emerging market governments are demonstrating better financial management by being more disciplined with their spending and successfully reducing debt relative to their economic growth. This progress is being recognized by ratings agencies, which awarded emerging market companies $70 billion in net credit rating upgrades in 2024—the strongest rebound in over a decade. This growing stability is also reflected in historically low default rates; on average, government debt has defaulted at just 0.7% annually, while corporate debt has defaulted at 4.1%. Furthermore, even in the rare event of a government default, major creditors like the World Bank have historically recovered over 90% of the money owed, significantly reducing the ultimate risk for investors.

A Weaker U.S. Dollar: A weaker U.S. dollar is a benefit for investors holding emerging and frontier market debt for two main reasons. First, for countries that borrowed in U.S. dollars, a weaker dollar makes their debt cheaper to repay. Think of it like this: if you earn your salary in pesos but have a loan in dollars, a weaker dollar means you need fewer pesos to make your monthly payment. This reduces the country's risk of financial trouble, making its bonds a safer and more valuable investment. Second, for investors holding EMD paid out in USD, a weaker dollar means that foreign currency is strengthening, so each unit of foreign currency buys more USD, boosting total return for those investors. This powerful combination of lower risk and higher potential currency gain may make EMD more attractive, drawing in more money and pushing yields lower (and prices of existing bonds higher).

Unloved and Underrepresented: We believe that bonds from the world's fastest-growing economies are widely ignored by both institutional and retail investors and the market may be beginning to recognize it. Emerging economies now power nearly 60% of the entire global economy. A significant disconnect exists between the growing economic importance of emerging and frontier markets and the remarkably low level of investment. We believe this points to a major opportunity to tap into overlooked sources of potential yield and increased demand.

The Quiet Outperformer

Emerging markets bonds have outperformed U.S. and global bonds over the past decade, offering high yields, strong fundamentals, and diversification amid global risks. Since they bottomed in 2022, emerging-market bond funds have pulled ahead, returning 8.3% a year over the past three years. That compares with a return of 2.1% for intermediate core and 6.9% for US high yield.

Concerns over the U.S. fiscal situation, domestic political dysfunction, and growing geopolitical uncertainty are causing investors to re-evaluate their U.S.-focused portfolios. In response, we believe investors will seek to increase their allocations to emerging and frontier markets.

For investors seeking yield, diversification, and global growth exposure, EMD may be a highly attractive asset class. Supported by improving fundamentals and a favorable macro outlook, we believe EMD offers a powerful complement to other non-correlated asset classes. Investors will likely be well-served by integrating EMD into their core portfolios, not merely as a tactical play, but as a strategic, long-term allocation. α

Interesting things I came across this week…

S&P Composite 187% Above Trend (Advisor Perspectives)

SEC paves way for more crypto ETFs with new listing rules (Reuters)

Why there will be plenty of jobs in the future — even with AI (WEF)

Samsung brings ads to US fridges (The Verge)

Download our Quarterly Investment Outlook

Alpha Rock offers a compelling alternative to traditional buy-and-hold investing by offering active, risk-managed portfolio management services focused on liquid alternative investments and risk management.

To learn more about how we are investing for clients and for our current views on the global investment landscape, download our Quarterly Investment Outlook.

We’d love to hear from you!

Your thoughts are important to us, so don’t hesitate to share them. They give us great motivation and encouragement.

IMPORTANT DISCLOSURE INFORMATION

This commentary reflects the personal opinions, viewpoints and analyses of the Alpha Rock Investments, LLC employees providing such comments, and should not be regarded as a description of advisory services provided by Alpha Rock Investments, LLC or performance returns of any Alpha Rock Investments, LLC client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Alpha Rock Investments, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

The S&P 500 Index or the Standard & Poor's 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The S&P 500 is a float-weighted index, meaning company market capitalizations are adjusted by the number of shares available for public trading. Note: Investors cannot invest directly in an index. These unmanaged indices do not reflect management fees and transaction costs that are associated with most investments.

Alpha Rock Investments, LLC provides links for your convenience to websites produced by other providers of industry related material. Accessing websites through links directs you away from our website. Alpha Rock Investments, LLC is not responsible for errors or omissions in the material on third party websites, and does not necessarily approve of or endorse the information provided. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from use of those websites.