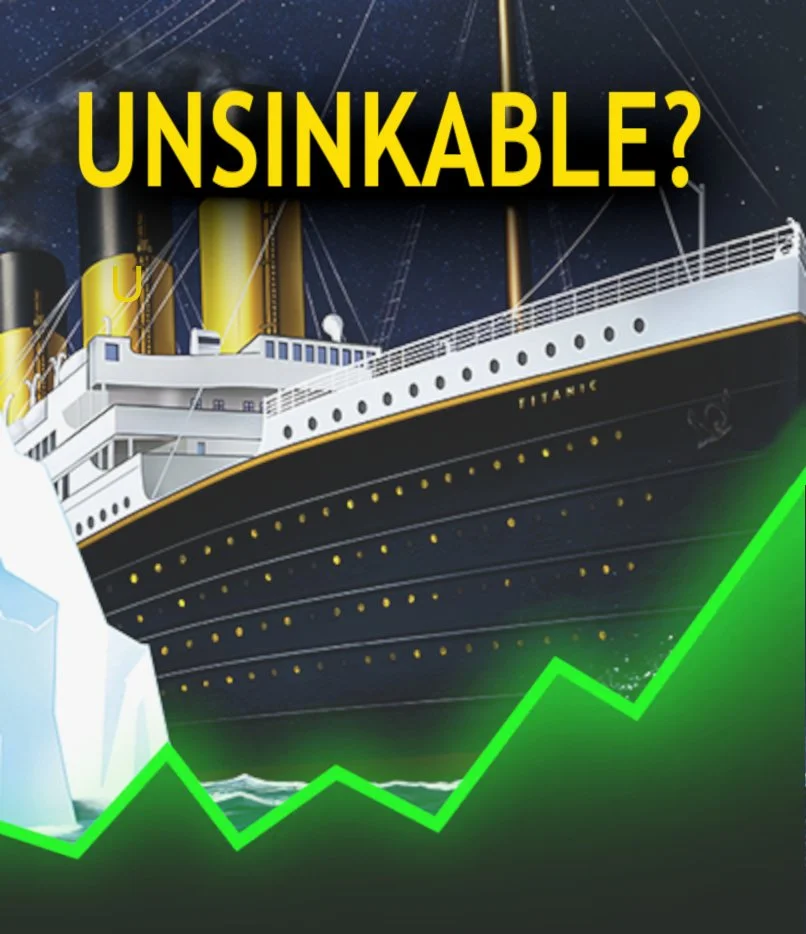

Is the Stock Market ‘Unsinkable’?

Weekly Investment Update | By Brian Schreiner

Investor confidence in stocks has reached a new level of extreme. There’s a growing belief that the U.S. stock market is ‘unsinkable.’ When I expressed this concern to a fellow investment advisor, his response was stunning: “They’re right; nothing can take this market down.”

Unsophisticated investors are results oriented and have short memories. They focus on outcomes, discounting inherent risks when things work out and they forget the lessons of market history. All they know, apparently, is that the market bounces back after every dip. “The data supports the fact that we are in a structural buy-the-dip era today, more so than for the last 100 years of U.S. equity market history,” according to Ben Bowler of Bank of America.

In 1911, the prestigious British journal, Shipbuilder, described the advanced watertight compartment system of the Titanic, concluding, "The captain can, by simply moving an electric switch, instantly close the doors throughout and make the vessel practically unsinkable." And in a promotional brochure, the owner of the Titanic, the White Star Line, claimed the ship was “designed to be unsinkable."

This confidence, rooted in its state-of-the-art technology, was picked up by the press and the public. The idea that the Titanic was a marvel of engineering that had conquered the dangers of the North Atlantic became a widespread belief. Survivors later testified that this sense of ultimate safety was common among both passengers (i.e. retail investors) and crew (i.e. investment professionals) before the voyage began.

Valuations Don’t Matter Until They Do

In simple terms, stock market valuation measures whether the overall market is expensive or cheap relative to the combined profits of the companies within it.

The term "valuation" helps answer the question, "How much are we paying for what we're actually getting?" It's not about the price level itself; it’s about how the price compares to the underlying business performance.

A high valuation means investors are paying a high price for each dollar of profit the companies are making and implies optimism about future growth and can suggest the market is overvalued or "expensive." A low valuation means investors are paying a low price for each dollar of profit, implying pessimism and/or that the market is undervalued or "cheap."

Much ink has been spilled about the lofty valuations of U.S. stocks in recent years, and rightfully so, because they’ve been extremely high for a very long time–hovering above the 90th percentile of all market history for nearly a decade. Understandably, investors have become numb hearing about the "extremely high valuations of U.S. stocks.”

Well, valuations reached a new extreme this month. Stocks are now more expensive than they were in 1999 and 1929. Simon White of Bloomberg noted, “Valuation is the capstone of proximate causes for a market top, and the one most indicative of the potential magnitude of any subsequent selloff. It’s well known that valuations are high for the U.S. market, but I thought I’d update my aggregate indicator, which combines the main measures of long-term stock-market worth. It previously peaked in April, but has just made a new all-time high this month. Not a welcome sign if you’re a long-term bull.”

Here’s how to put valuations into the correct context:

Market valuations should NOT be used for market timing (i.e. they don’t tell you when markets will turn)

Market valuations are NOT a catalyst for mean reversions (i.e. they don’t cause markets to revert to their long term averages)

Market valuations ARE good predictors of likely forward returns over 7- to 10-year periods (i.e. high valuations tend precede periods of lower returns and low valuations tend to precede periods of higher returns)

Market valuations ARE a good measure of investor psychology (i.e. the greater fool theory: investors tend to be bullish at high valuations and bearish at low valuations)

What does the chart suggest?

Investors are extremely confident and bullish. Stocks are very expensive and likely overvalued by investors. Future returns are likely to be low, but we don’t know when the bull market will end. The chart can’t help with buy/sell decisions, but it can help us formulate our investment strategy.

Extreme market valuations leave investors dangerously exposed to unforeseen, exogenous events, which are known to cause abrupt shifts in sentiment. The precise nature of such an event is inherently unpredictable, which is why risk management is more important than ever today.

If you’d like to learn how we’re invested and why, our Quarterly Outlook goes in depth. If you think your investments are over-exposed to the stock market, this is a great time to review your portfolio. Click here to view my calendar and schedule a call. α

Interesting things I came across this week…

Are recessions really a thing of the past? (MarketWatch)

U.S. government takes 10% stake in Intel (CNBC)

97% of institutional fund managers reported no bitcoin exposure. (BiTBO)

Winner of Air Guitar World Championships scores guitar (WTVR CBS 6)

Download our Quarterly Investment Outlook

Alpha Rock offers a compelling alternative to traditional buy-and-hold investing by offering active, risk-managed portfolio management services focused on liquid alternative investments and risk management.

To learn more about how we are investing for clients and for our current views on the global investment landscape, download our Quarterly Investment Outlook.

We’d love to hear from you!

Your thoughts are important to us, so don’t hesitate to share them. They give us great motivation and encouragement.

IMPORTANT DISCLOSURE INFORMATION

This commentary reflects the personal opinions, viewpoints and analyses of the Alpha Rock Investments, LLC employees providing such comments, and should not be regarded as a description of advisory services provided by Alpha Rock Investments, LLC or performance returns of any Alpha Rock Investments, LLC client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this commentary constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Alpha Rock Investments, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

The S&P 500 Index or the Standard & Poor's 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The S&P 500 is a float-weighted index, meaning company market capitalizations are adjusted by the number of shares available for public trading. Note: Investors cannot invest directly in an index. These unmanaged indices do not reflect management fees and transaction costs that are associated with most investments.

Alpha Rock Investments, LLC provides links for your convenience to websites produced by other providers of industry related material. Accessing websites through links directs you away from our website. Alpha Rock Investments, LLC is not responsible for errors or omissions in the material on third party websites, and does not necessarily approve of or endorse the information provided. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from use of those websites.